ATT Inc.: wave analysis 12 February 2019, 08:37

ATT Inc.: wave analysis

12 February 2019, 08:37

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 29.71 |

| Take Profit | 34.28, 39.33 |

| Stop Loss | 26.78 |

| Key Levels | 24.00, 25.03, 26.78, 34.28, 39.33 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 26.70 |

| Take Profit | 25.03, 24.00 |

| Stop Loss | 27.30 |

| Key Levels | 24.00, 25.03, 26.78, 34.28, 39.33 |

The price may grow.

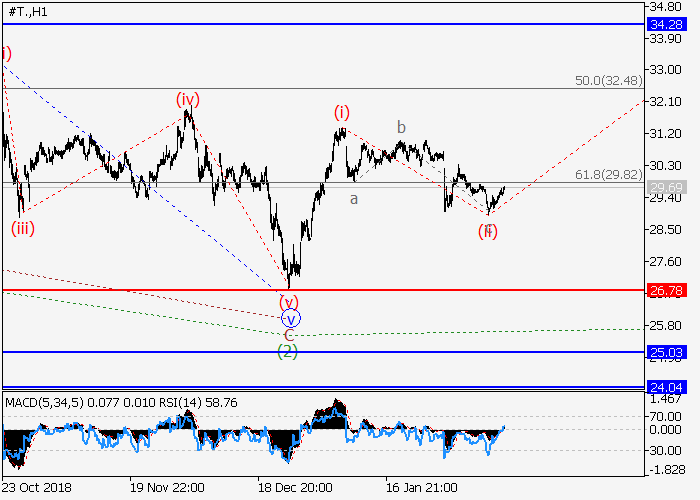

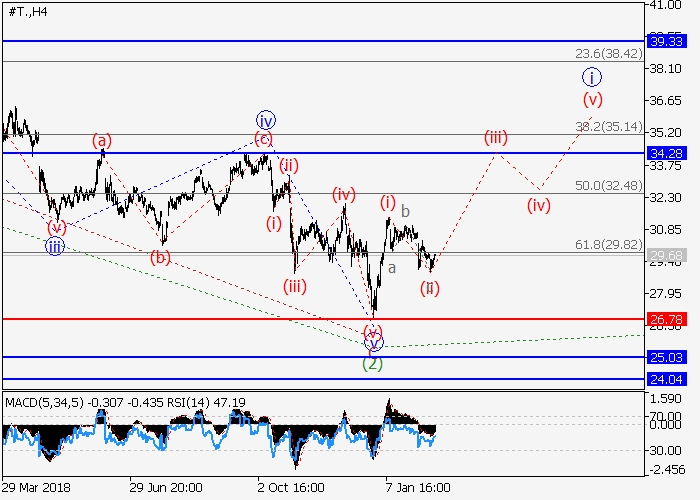

On the 4-hour chart, a downward correction of the higher level developed as the wave (2). Now the formation of the third wave (3) has begun, within which the first entry wave of the lower level (i) of i of 1 of (3) has formed, and the local correction (ii) of i has ended. If the assumption is correct, the price will grow to the levels of 34.28–39.33. In this scenario, critical stop loss level is 26.78.

Main scenario

Long positions will become relevant during the correction, above the level of 26.78 with the targets at 34.28–39.33. Implementation period: 7 days and more.

Alternative scenario

The breakdown and the consolidation of the price below the level of 26.78 will let the price go down to the levels of 25.03–24.00.

On the 4-hour chart, a downward correction of the higher level developed as the wave (2). Now the formation of the third wave (3) has begun, within which the first entry wave of the lower level (i) of i of 1 of (3) has formed, and the local correction (ii) of i has ended. If the assumption is correct, the price will grow to the levels of 34.28–39.33. In this scenario, critical stop loss level is 26.78.

Main scenario

Long positions will become relevant during the correction, above the level of 26.78 with the targets at 34.28–39.33. Implementation period: 7 days and more.

Alternative scenario

The breakdown and the consolidation of the price below the level of 26.78 will let the price go down to the levels of 25.03–24.00.

Post a Comment