Fuad Karimov's daily comment: USD/JPY chart review

Fuad Karimov's daily comment: USD/JPY chart review

13 February 2019, 13:44

The USD/JPY traded higher during morning session amid a global risk-on mood.

It affects on JPY demand as investors cheerful about upcoming breakthrough in

the US-China trade talks and elimination of treat of another US government

shut-down.

However, as I am convinced, this rally mood is not forever and definitely stock markets (and USD/JPY for that matter) are overbought. I believe it is likely time for technical correction, despite FED’s dovish stance. Today’s expected is US inflation data which will define further price action and if data is not great enough it might trigger the sell-off.

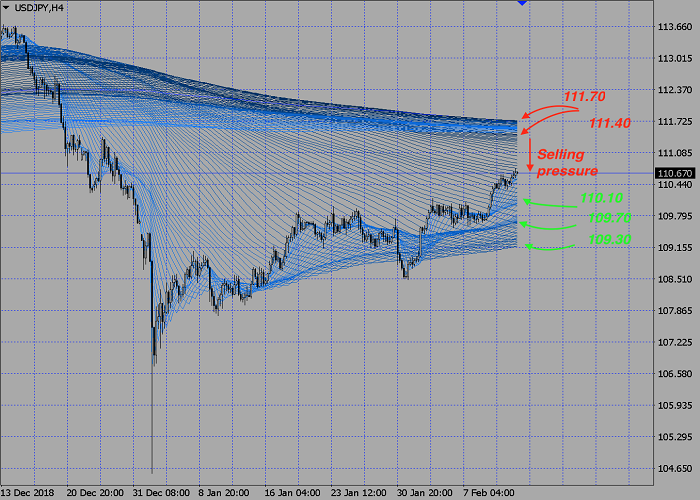

USD/JPY H4 chart

My point is technical, however. We see the powerful resistance cluster hanging above the current price and this 111.40-111.70 is exactly the area of entering short trade.

Current price level is also a resistance area and I would personally scale into short trade from 110.70 and if price goes up, add to the position.

Below are supports 110.10 and in particular 109.70 and 109.30 which are able to contain first impulse down.

Have a nice day!

However, as I am convinced, this rally mood is not forever and definitely stock markets (and USD/JPY for that matter) are overbought. I believe it is likely time for technical correction, despite FED’s dovish stance. Today’s expected is US inflation data which will define further price action and if data is not great enough it might trigger the sell-off.

USD/JPY H4 chart

My point is technical, however. We see the powerful resistance cluster hanging above the current price and this 111.40-111.70 is exactly the area of entering short trade.

Current price level is also a resistance area and I would personally scale into short trade from 110.70 and if price goes up, add to the position.

Below are supports 110.10 and in particular 109.70 and 109.30 which are able to contain first impulse down.

Have a nice day!

Post a Comment