IBM Corp.: wave analysis

IBM Corp.: wave analysis

13 February 2019, 08:37

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 132.50 |

| Take Profit | 105.90 |

| Stop Loss | 146.10 |

| Key Levels | 105.90, 146.10, 154.20, 161.90 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 146.15 |

| Take Profit | 154.20, 161.90 |

| Stop Loss | 143.45 |

| Key Levels | 105.90, 146.10, 154.20, 161.90 |

The price is in correction, the fall is possible.

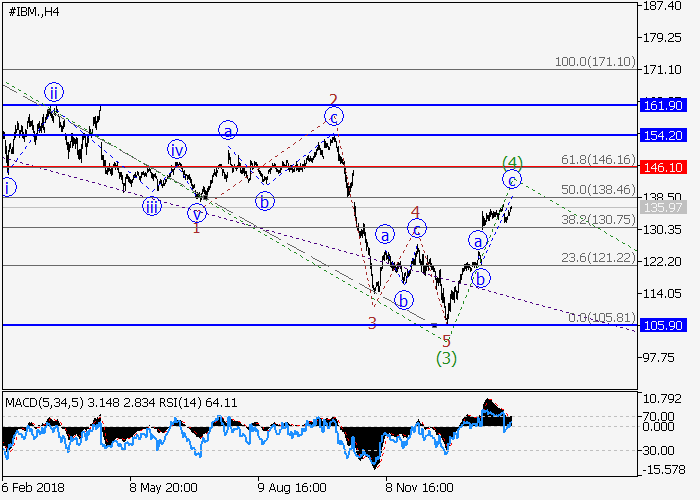

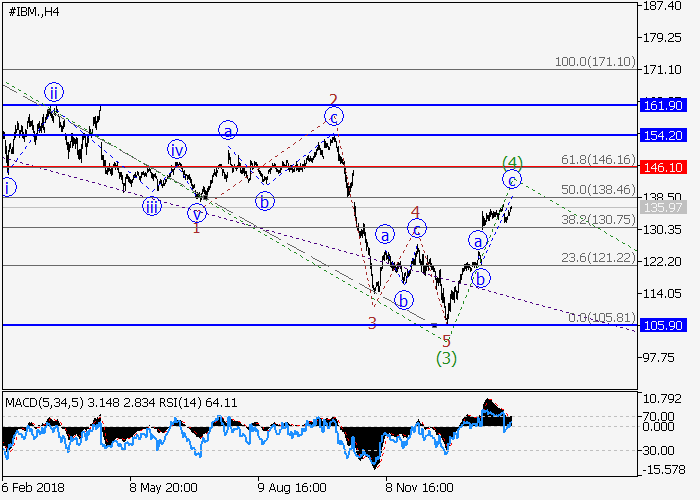

On the 4-hour chart, the third wave of the higher level (3) developed. Now the formation of an upward correction as the fourth wave (4) is ending, within which the wave c of (4) is developing. If the assumption is correct, after the end of the correction, the price will fall to the level of 105.90. In this scenario, critical stop loss level is 146.10.

Main scenario

Short positions will become relevant after the end of the correction, below the level of 146.10 with the target at 105.90. Implementation period: 7 days and more.

Alternative scenario

The breakout and the consolidation of the price above the level of 146.10 will let the price grow to the levels of 154.20–161.90.

On the 4-hour chart, the third wave of the higher level (3) developed. Now the formation of an upward correction as the fourth wave (4) is ending, within which the wave c of (4) is developing. If the assumption is correct, after the end of the correction, the price will fall to the level of 105.90. In this scenario, critical stop loss level is 146.10.

Main scenario

Short positions will become relevant after the end of the correction, below the level of 146.10 with the target at 105.90. Implementation period: 7 days and more.

Alternative scenario

The breakout and the consolidation of the price above the level of 146.10 will let the price grow to the levels of 154.20–161.90.

Post a Comment