NZD/USD: general review

NZD/USD: general review

13 February 2019, 14:06

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 0.6820 |

| Take Profit | 0.6905, 0.6970, 0.7000 |

| Stop Loss | 0.6770 |

| Key Levels | 0.6590, 0.6650, 0.6770, 0.6800, 0.6815, 0.6850, 0.6905, 0.6940, 0.6970, 0.7000 |

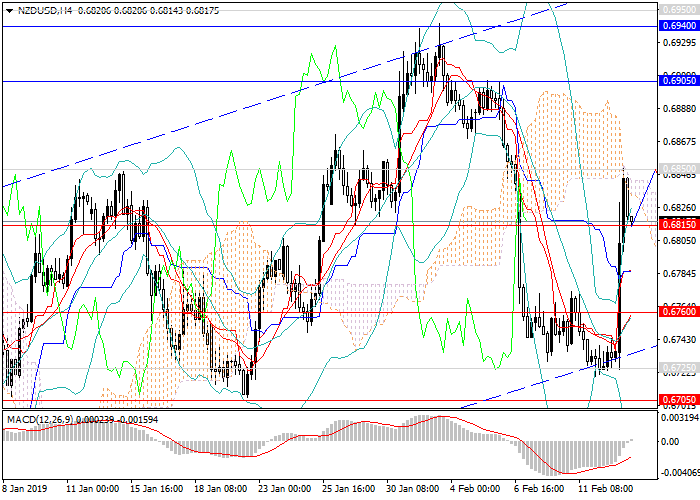

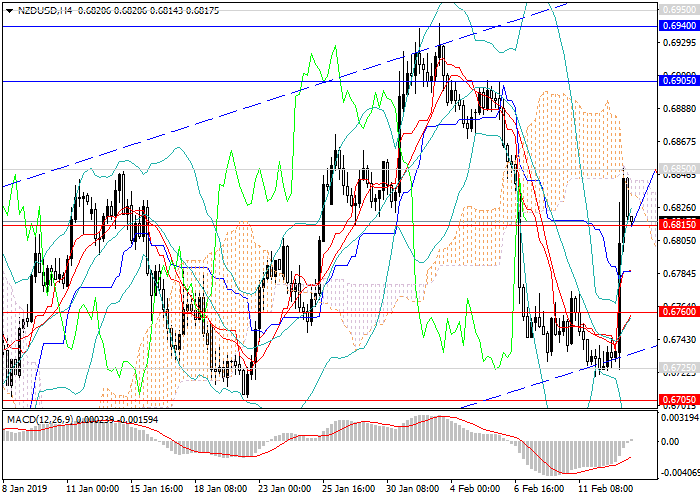

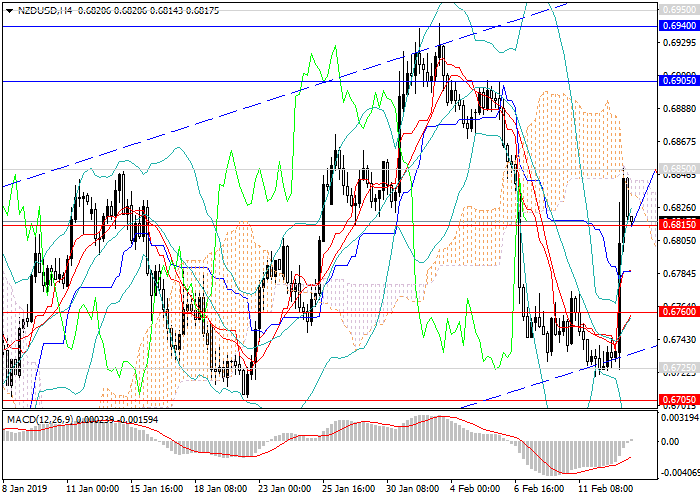

Current trend

In early February, NZD was rapidly declining against USD amid latter's strengthening due to increased demand and favorable macroeconomic data.

This week, the pair reached the lower border of the medium-term wide range at 0.6725 and consolidated above it. Today, RBNZ kept the interest rate at 1.75%, however, optimistic statements about inflation and the labor market and the likelihood of the rate increase allowed the instrument to break out some key resistance levels and gain 120 points in a few hours. Later, the pair slightly corrected to the level of 0.6815 and consolidated above it.

Today, data on inflation in the US will be published but it is unlikely to seriously strengthen USD. At the end of the week, there will be releases on retail sales, industrial production, and the US labor market.

Support and resistance

In the short term, the transition to lateral consolidation is expected. Later, the upward impulse may increase, which will provide growth to 0.6905, 0.6940 with a high probability of testing new highs at the upper border of the upward trend (0.6970, 0.7000). If the pair consolidates below 0.6815, 0.6800, one should await a decline to the local minimum and the lower border of the channel at 0.6725, breaking it down and moving to a downward trend with the target at 0.6590.

Technical indicators on H4 and D1 do not give a strong signal for any of the scenarios: MACD indicates a sharp decrease in the volume of short positions, the signal line approached the zero level, and Bollinger Bands lined up horizontally.

Support levels: 0.6850, 0.6905, 0.6940, 0.6970, 0.7000.

Resistance levels: 0.6815, 0.6800, 0.67705, 0.6650, 0.6590.

Trading tips

Long positions may be opened from the current level with targets at 0.6905, 0.6970, 0.7000 and stop loss at 0.6770.

In early February, NZD was rapidly declining against USD amid latter's strengthening due to increased demand and favorable macroeconomic data.

This week, the pair reached the lower border of the medium-term wide range at 0.6725 and consolidated above it. Today, RBNZ kept the interest rate at 1.75%, however, optimistic statements about inflation and the labor market and the likelihood of the rate increase allowed the instrument to break out some key resistance levels and gain 120 points in a few hours. Later, the pair slightly corrected to the level of 0.6815 and consolidated above it.

Today, data on inflation in the US will be published but it is unlikely to seriously strengthen USD. At the end of the week, there will be releases on retail sales, industrial production, and the US labor market.

Support and resistance

In the short term, the transition to lateral consolidation is expected. Later, the upward impulse may increase, which will provide growth to 0.6905, 0.6940 with a high probability of testing new highs at the upper border of the upward trend (0.6970, 0.7000). If the pair consolidates below 0.6815, 0.6800, one should await a decline to the local minimum and the lower border of the channel at 0.6725, breaking it down and moving to a downward trend with the target at 0.6590.

Technical indicators on H4 and D1 do not give a strong signal for any of the scenarios: MACD indicates a sharp decrease in the volume of short positions, the signal line approached the zero level, and Bollinger Bands lined up horizontally.

Support levels: 0.6850, 0.6905, 0.6940, 0.6970, 0.7000.

Resistance levels: 0.6815, 0.6800, 0.67705, 0.6650, 0.6590.

Trading tips

Long positions may be opened from the current level with targets at 0.6905, 0.6970, 0.7000 and stop loss at 0.6770.

Post a Comment