SPX: general analysis

SPX: general analysis

13 February 2019, 08:58

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 2734.4 |

| Take Profit | 2798.3 |

| Stop Loss | 2714.8 |

| Key Levels | 2714.8, 2734.4, 2779.2, 2798.3 |

Current trend

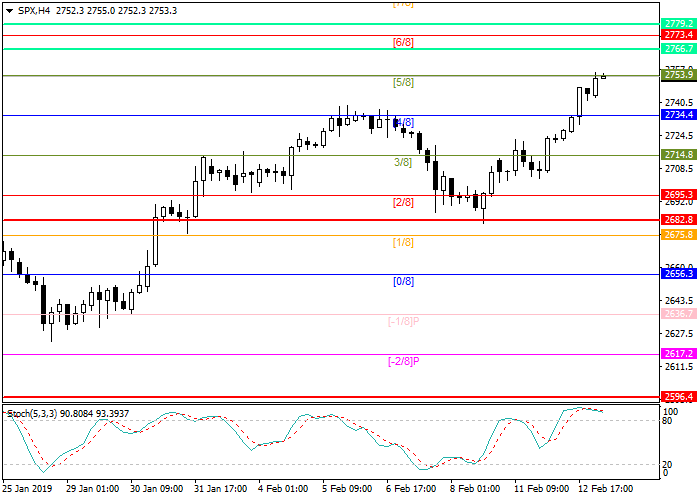

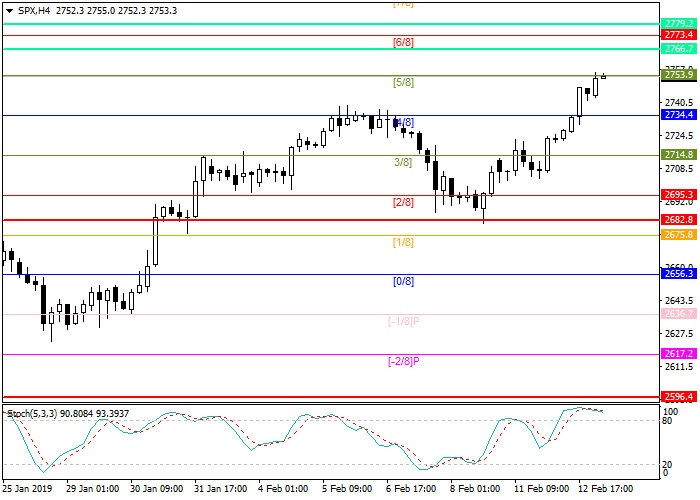

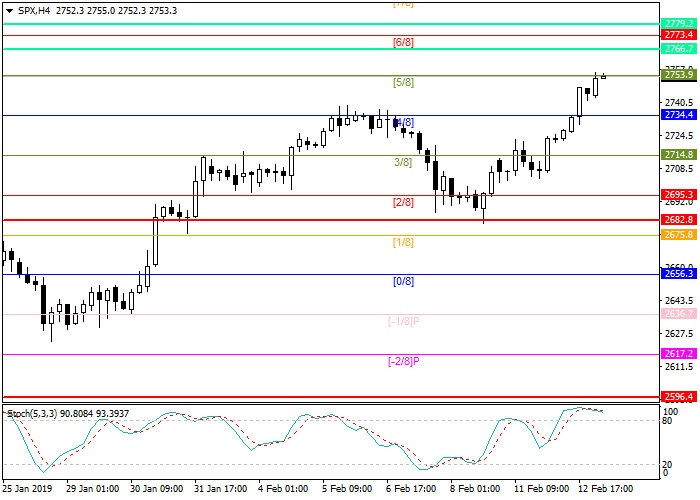

The US broad spectrum index S&P 500 continues to grow. The price reached the resistance level of 5/8 Murrey or 2753.9, and the next target will be the level of 2779.2.

On Monday, the demand for shares was caused by the news of the upcoming meeting of ministers of the United States and China in Beijing, where the next round of trade talks will take place. It is predicted that both parties will be able to reach a final agreement before March 2. Otherwise, Washington will increase protective duties on Chinese goods from the current 10% to 25%. The second positive factor for the market is the decision on budgetary issues between Republicans and Democrats: the Shutdown was avoided. According to the new budget, part of the money for the construction of the barrier wall on the border with Mexico will be allocated but the project will amount to only 1.4 billion dollars against 5.7 billion initially demanded by Donald Trump.

The season of reporting of American corporations continues: this week, NVidia, Coca-Cola and Activation Blizzard will report on their profits. In addition, today data on the consumer price index and the federal budget for December will be published.

Support and resistance

Stochastic is at 92 points and signals a possibility of a correction.

Resistance levels: 2779.2, 2798.3.

Support levels: 2734.4, 2714.8.

Trading tips

Long positions can be opened from the level of 2734.4 with the target at 2798.3 and stop loss 2714.8.

The US broad spectrum index S&P 500 continues to grow. The price reached the resistance level of 5/8 Murrey or 2753.9, and the next target will be the level of 2779.2.

On Monday, the demand for shares was caused by the news of the upcoming meeting of ministers of the United States and China in Beijing, where the next round of trade talks will take place. It is predicted that both parties will be able to reach a final agreement before March 2. Otherwise, Washington will increase protective duties on Chinese goods from the current 10% to 25%. The second positive factor for the market is the decision on budgetary issues between Republicans and Democrats: the Shutdown was avoided. According to the new budget, part of the money for the construction of the barrier wall on the border with Mexico will be allocated but the project will amount to only 1.4 billion dollars against 5.7 billion initially demanded by Donald Trump.

The season of reporting of American corporations continues: this week, NVidia, Coca-Cola and Activation Blizzard will report on their profits. In addition, today data on the consumer price index and the federal budget for December will be published.

Support and resistance

Stochastic is at 92 points and signals a possibility of a correction.

Resistance levels: 2779.2, 2798.3.

Support levels: 2734.4, 2714.8.

Trading tips

Long positions can be opened from the level of 2734.4 with the target at 2798.3 and stop loss 2714.8.

Post a Comment