USD/JPY: general review

USD/JPY: general review

13 February 2019, 11:01

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 110.67 |

| Take Profit | 111.35 |

| Stop Loss | 110.35 |

| Key Levels | 109.41, 109.60, 109.89, 110.07, 110.32, 110.77, 111.38, 112.18 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.00 |

| Take Profit | 109.45 |

| Stop Loss | 110.35 |

| Key Levels | 109.41, 109.60, 109.89, 110.07, 110.32, 110.77, 111.38, 112.18 |

Current trend

The pair USD/JPY showed ambiguous dynamics at the trading on Tuesday. Generally, the yen was pressured by negative statistics.

The Index of Tertiary Industry Activity in Japan in December declined for the second month in a row, this time by 0.3%. The demand for machine-building products in January declined for the 4th consecutive month, this time by 18.8%.

The dollar, in turn, received support against the backdrop of an agreement reached in Washington to continue the work of the government and the statement by President Donald Trump about the low probability of a new shutdown.

The data on Japanese Producer Price Index have been released today. The indicator fell by 0.6% on a monthly basis, not justifying the forecast of –0.2%, and recorded an increase of 0.6% in annual terms, which turned out to be lower than the forecast growth of 1.1%.

In the United States, January inflation data will be released today. On an annualized basis, the Consumer Price Index may drop significantly from 1.9% to 1.5%, and the Core Consumer Price Index can decrease from 2.2% to 2.1%. The market is expected to be highly volatile.

Support and resistance

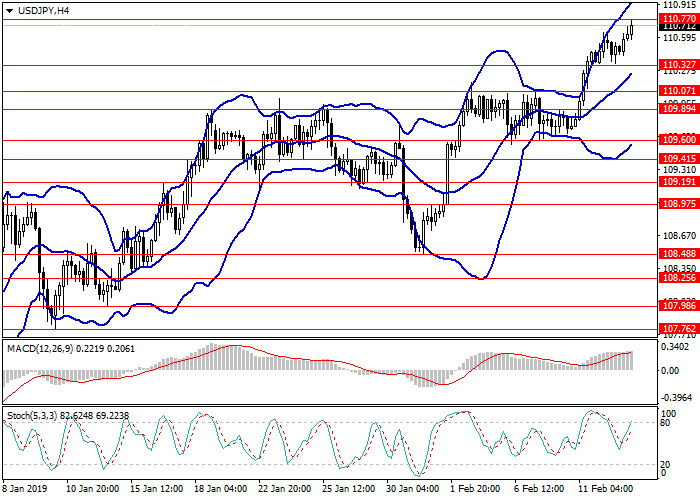

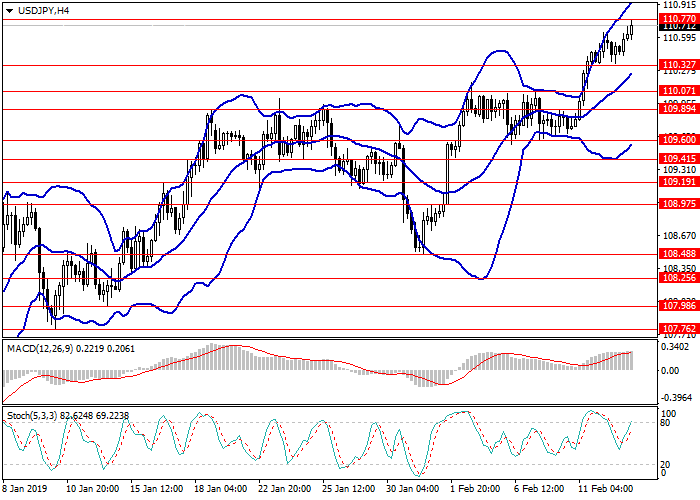

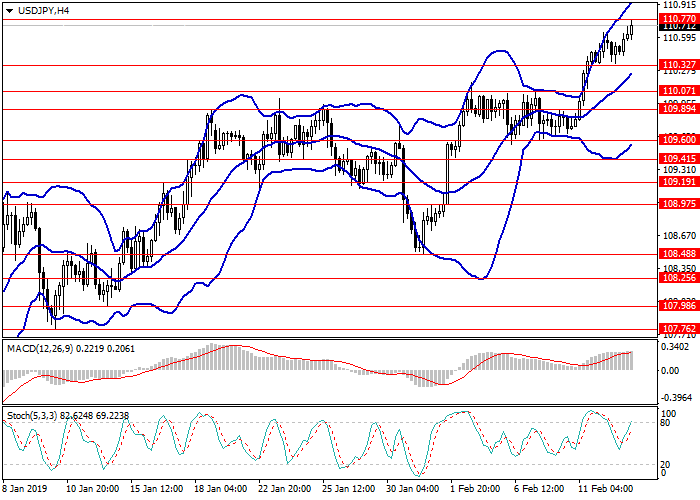

On H4 chart, the instrument is growing along the upper border of Bollinger Bands, and the price range is widened. MACD histogram is in the positive area. The signal line is crossing the body of the histogram from below giving a stable signal for opening short positions.

Resistance levels: 110.77, 111.38, 112.18.

Support levels: 110.32, 110.07, 109.89, 109.60, 109.41.

Trading tips

Long positions may be opened from the current level with target at 111.35 and stop loss at 110.35.

Short positions may be opened from the level of 110.00 with target at 109.45 and stop loss at 110.35.

Implementation time: 1-3 days.

The pair USD/JPY showed ambiguous dynamics at the trading on Tuesday. Generally, the yen was pressured by negative statistics.

The Index of Tertiary Industry Activity in Japan in December declined for the second month in a row, this time by 0.3%. The demand for machine-building products in January declined for the 4th consecutive month, this time by 18.8%.

The dollar, in turn, received support against the backdrop of an agreement reached in Washington to continue the work of the government and the statement by President Donald Trump about the low probability of a new shutdown.

The data on Japanese Producer Price Index have been released today. The indicator fell by 0.6% on a monthly basis, not justifying the forecast of –0.2%, and recorded an increase of 0.6% in annual terms, which turned out to be lower than the forecast growth of 1.1%.

In the United States, January inflation data will be released today. On an annualized basis, the Consumer Price Index may drop significantly from 1.9% to 1.5%, and the Core Consumer Price Index can decrease from 2.2% to 2.1%. The market is expected to be highly volatile.

Support and resistance

On H4 chart, the instrument is growing along the upper border of Bollinger Bands, and the price range is widened. MACD histogram is in the positive area. The signal line is crossing the body of the histogram from below giving a stable signal for opening short positions.

Resistance levels: 110.77, 111.38, 112.18.

Support levels: 110.32, 110.07, 109.89, 109.60, 109.41.

Trading tips

Long positions may be opened from the current level with target at 111.35 and stop loss at 110.35.

Short positions may be opened from the level of 110.00 with target at 109.45 and stop loss at 110.35.

Implementation time: 1-3 days.

Post a Comment