Ethereum: general review

Ethereum: general review

12 February 2019, 12:09

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 120.00 |

| Take Profit | 125.50, 137.50 |

| Stop Loss | 114.00 |

| Key Levels | 100.00, 106.00, 112.50, 125.00, 137.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 112.00 |

| Take Profit | 106.00, 100.00 |

| Stop Loss | 120.00 |

| Key Levels | 100.00, 106.00, 112.50, 125.00, 137.50 |

Current trend

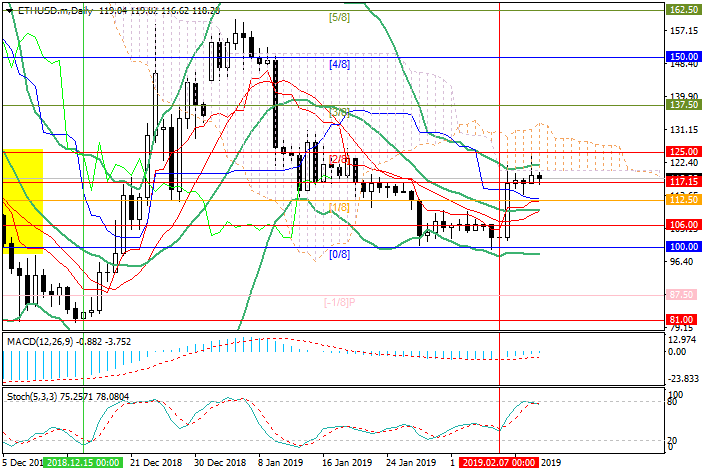

Last Friday, the price of Ether rose sharply to 117.15, adding about 12%, and returned to the second place in terms of capitalization, displacing Ripple to third place. The driver of the movement was the comments of representatives of the US Securities and Exchange Commission (SEC), which inspired investors that ETF approval is possible in the foreseeable future.

This week, Ethereum, unlike most other cryptocurrencies, did not resume declines but continued growth attempts. Experts attribute this to the imminent release of the Constantinople update, which has been constantly postponed since November last year. Its launch is scheduled for the end of February; in particular, it should improve the performance of the Ethereum network, reduce the remuneration of miners from 3 to 2 ETH per block and stabilize emissions at 13,400 ETH per day. Investors believe that this time the fork will be successful, and therefore prefer to buy Ether.

Support and resistance

Currently, the price is above 117.15 and is trying to grow. The “bullish” targets are 125.00 (Murrey [2/8]) and 137.50 (Murrey [3/8]). However, a reversal and the beginning of a downward correction cannot be excluded, as indicated by the output of Stochastic to the overbought zone. In case of a breakdown of the level of 112.50 (Murrey [1/8]), quotations may return to the area of 100.00 (Murrey [0/8]).

Resistance levels: 125.00, 137.50.

Support levels: 112.50, 106.00, 100.00.

Trading tips

Long positions can be opened from the level of 120.00 with the targets at 125.50, 137.50 and stop loss around 114.00.

Short positions can be opened below the level of 112.50 with the targets at 106.00, 100.00 and stop loss 120.00.

Implementation period: 3–4 days.

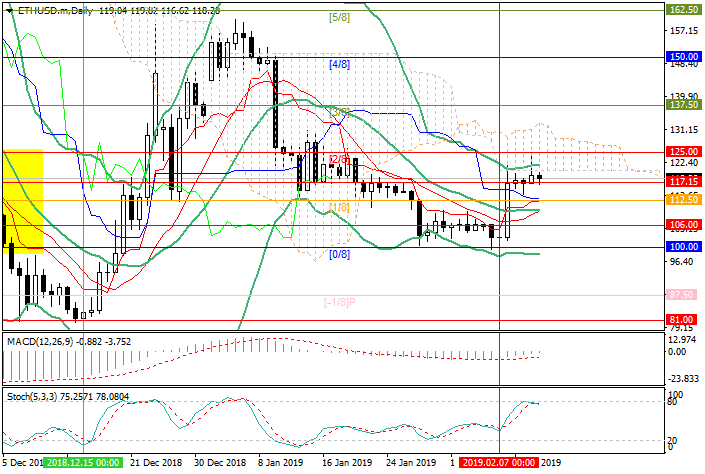

Last Friday, the price of Ether rose sharply to 117.15, adding about 12%, and returned to the second place in terms of capitalization, displacing Ripple to third place. The driver of the movement was the comments of representatives of the US Securities and Exchange Commission (SEC), which inspired investors that ETF approval is possible in the foreseeable future.

This week, Ethereum, unlike most other cryptocurrencies, did not resume declines but continued growth attempts. Experts attribute this to the imminent release of the Constantinople update, which has been constantly postponed since November last year. Its launch is scheduled for the end of February; in particular, it should improve the performance of the Ethereum network, reduce the remuneration of miners from 3 to 2 ETH per block and stabilize emissions at 13,400 ETH per day. Investors believe that this time the fork will be successful, and therefore prefer to buy Ether.

Support and resistance

Currently, the price is above 117.15 and is trying to grow. The “bullish” targets are 125.00 (Murrey [2/8]) and 137.50 (Murrey [3/8]). However, a reversal and the beginning of a downward correction cannot be excluded, as indicated by the output of Stochastic to the overbought zone. In case of a breakdown of the level of 112.50 (Murrey [1/8]), quotations may return to the area of 100.00 (Murrey [0/8]).

Resistance levels: 125.00, 137.50.

Support levels: 112.50, 106.00, 100.00.

Trading tips

Long positions can be opened from the level of 120.00 with the targets at 125.50, 137.50 and stop loss around 114.00.

Short positions can be opened below the level of 112.50 with the targets at 106.00, 100.00 and stop loss 120.00.

Implementation period: 3–4 days.

Post a Comment