Fuad Karimov's daily comment: DAX index price action review 12 February 2019, 11:13

Fuad Karimov's daily comment: DAX index price action review

12 February 2019, 11:13

Asian stocks are high again on supposedly good

expectations from US-Us-China talks. Risk-on mood continues to reign and

Japanese Nikkei 225 closes 2.61 % higher. Chinese stocks, however, were flat, as

well as US e-minis.

DAX index, however,

popped up after opening though it is difficult to see why. Perhaps some Brexit

comments or aftershocks of Japanese market rally.

I believe this is a short-term move and we all

yet to wait till US market opening where the main dynamics of the day will be

defined.

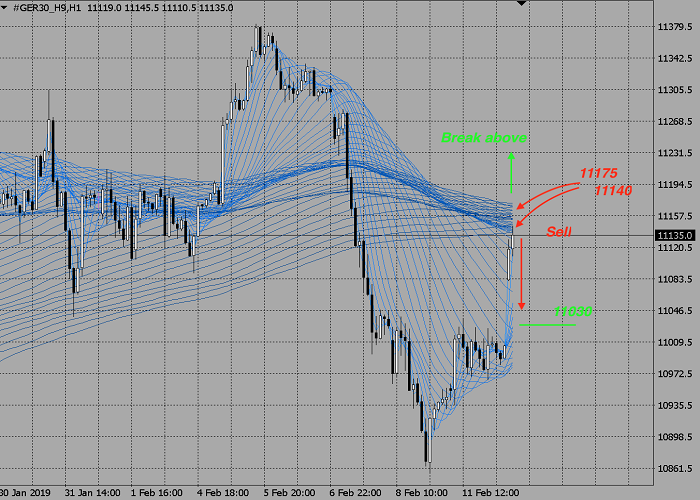

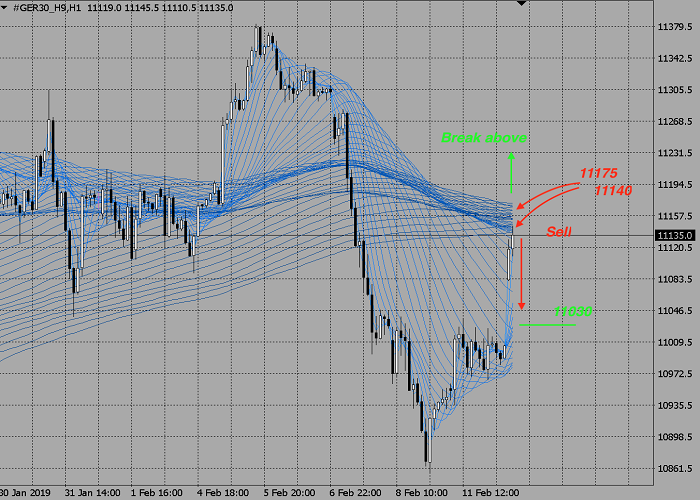

DAX H1 chart

Technical picture on H1 chart suggests that

price is at medum-importance resistance level 11140.0-11175.0 after bullish

impulse of early European hours.

This will indicate that the up move will

likely to fade away and this is a good tactical short opportunity. Sell from

current levels or anywhere within resistance area with close stop losses above

for the case of sudden break-up.

Corrective move down is likely to end at

11030.0 which is previous strong resistance turned support.

Have a nice week!

Post a Comment